FinCEN New Reporting Requirements

This information is from the Department of Financial Crimes website. This page is not intended as advice, and we recommend you visit their website for a complete overview. https://www.fincen.gov/boi-faqs

On September 30, 2022, the Treasury Department's Financial Crimes Enforcement Network (FinCEN) issued a final "Reporting Rule" requiring businesses to disclose their beneficial ownership information (BOI) in accordance with the Corporate Transparency Act.

In September 2023, FinCEN released the Small Entity Compliance Guide to help businesses meet the beneficial ownership reporting requirements. The Guide has useful information like what a "beneficial owner" is according to the reporting rule, what information entities must report, and how to file a report. Along with that, the guide lists the 23 types of organizations that are exempt from reporting requirements, FinCEN also wants to set up a call center to answer questions about the rules for reporting beneficial ownership.

-

Beneficial ownership information is identifying information about individuals who directly or indirectly own or control a company.

-

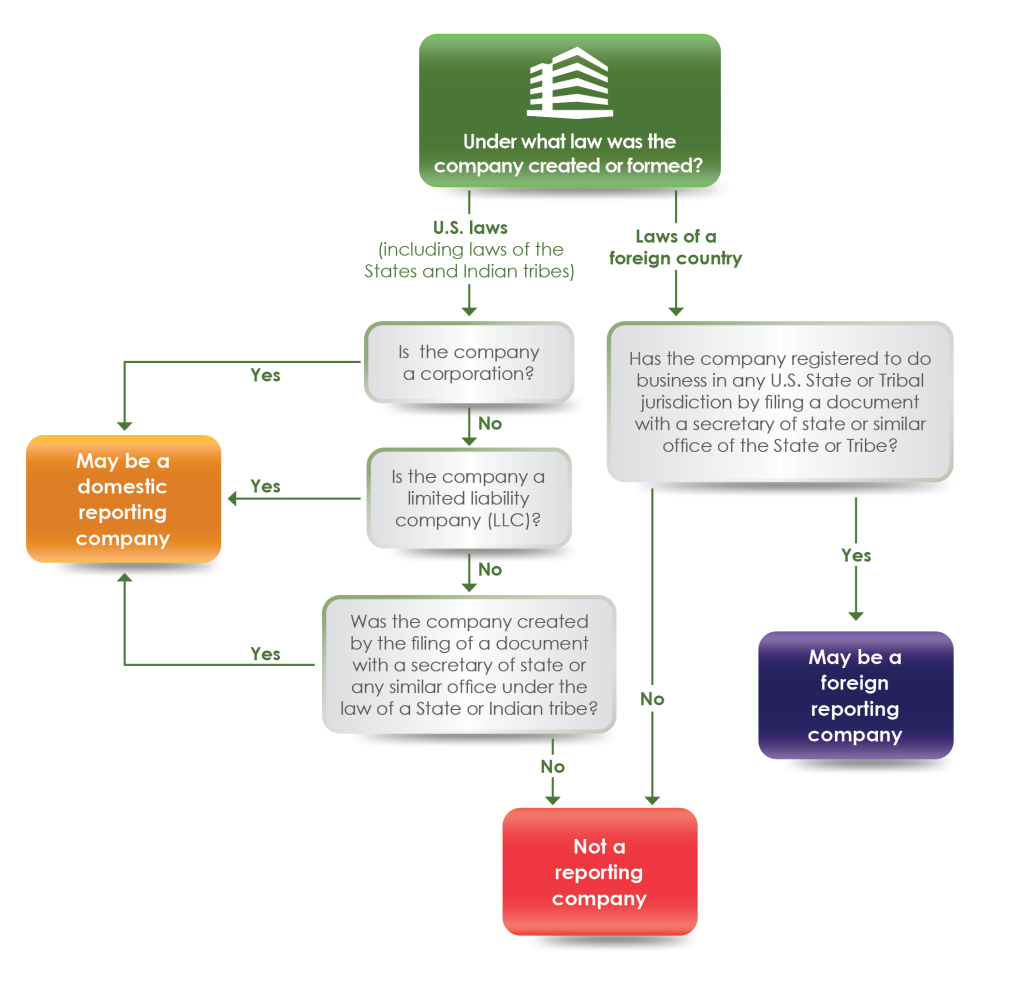

Under the CTA, there are two types of reporting companies: domestic and foreign

1. A domestic reporting company is a corporation, LLC, or any entity created by the filing of a document with a secretary of state or similar office under the state or Indian tribe law.

2. A foreign reporting company is a corporation, LLC, or other entity formed under the law of a foreign country that is registered to do business in any state or tribal jurisdiction by filing a document with a secretary of state or any similar office.

-

See Chart 1

-

See Chart 2

-

It is a business that:

1. has more than 20 full-time employees in the US;

2. has a physical office in the US where it does business; and

3. filed a federal income tax return in the US for the previous year showing more than $5 million in gross receipts or sales, excluding sales from outside the United States.

-

The "beneficial owner" is any natural person who, directly or indirectly, through a contract, arrangement, understanding, relationship, or other means:

1. Exercises “substantial control” over a reporting company, or

2. Owns or controls 25% or more of a reporting company’s “ownership interests.”

-

A person is considered to have "substantial control" over a reporting company if he or she meets one of the four criteria listed below.

✦ The individual is a senior officer (the company's president, CFO, CEO, COO, or any other officer who performs similar functions).

✦ The individual has authority to appoint or remove certain officers or a majority of directors (or a similar body) of the reporting company.

✦ The person is a key decision-maker for the reporting company.

✦ The individual has any other form of substantial control over the reporting company.

-

Reporting companies are required to identify all individuals who own or control at least 25% of the ownership interests of the company. Any of the following may be an ownership interest:

✦ equity, stock, or voting rights;

✦ a capital or profit interest;

✦ convertible instruments;

✦ options or other non-binding privileges to buy or sell equity, stock, or voting rights, etc.

✦ any other instrument, contract, or other mechanism used to establish ownership.

-

There are 5 exceptions to the definition of beneficial owner. When a person qualifies for an exception, the reporting company is exempt from reporting that person as a beneficial owner in its BOI report to FinCEN.

1. Minor Child (the reporting company must report information regarding the minor child’s parent or legal guardian)

2. An individual acting as a nominee, intermediary, custodian, or agent on behalf of another individual (in which case that individual would be the beneficial owner).

3. Employee. If all 3 criteria are met, the individual who is an employee of the reporting company qualifies for this exception:

✦ The individual is subject to the employer's will and control over what and how work is done, and the employer has the right to fire the individual.

✦ The individual's substantial control over or economic benefits from the reporting company are solely from employment.

✦ The individual is not a senior officer of the reporting company.

4. An individual whose only interest in the reporting company is a future interest based on an inheritance right. (This exception no longer applies once the individual inherits the interest, and the individual may qualify as a beneficial owner.)

5. Creditor of the reporting company

-

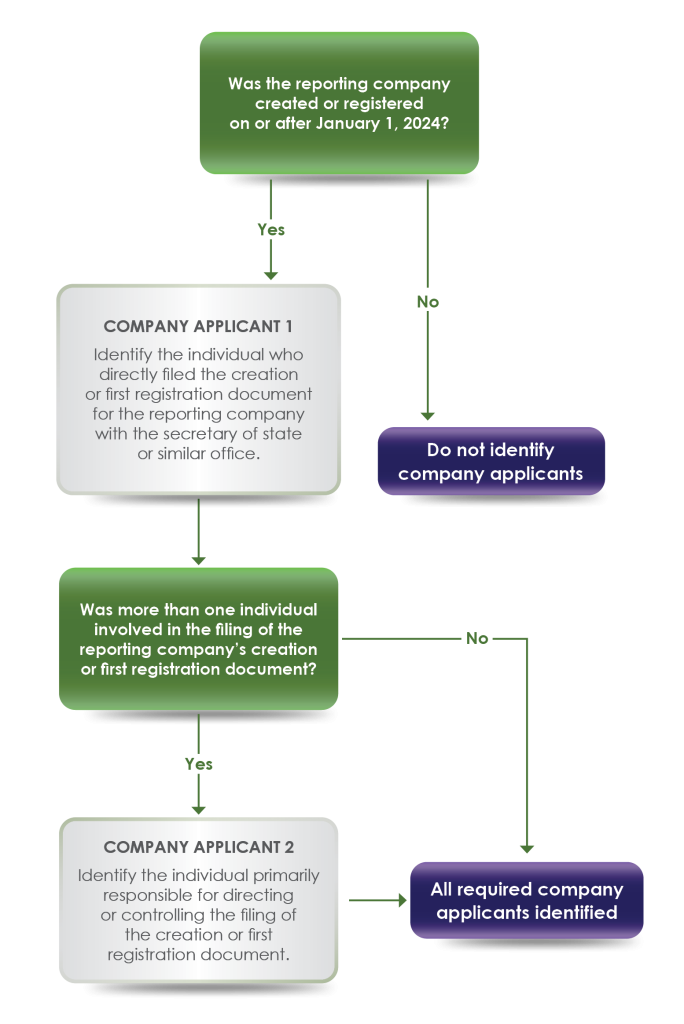

Only reporting companies formed or registered on or after January 1, 2024, will be required to report their applicant companies. A reporting company must report its company applicant if it is either a:

✦ domestic reporting company created on or after January 1, 2024; or

✦ foreign reporting company first registered to do business in the United States on or after January 1, 2024.

-

✦ If the reporting company was formed, incorporated, or registered prior to January 1, 2024, the initial BOI report is due before January 1, 2025.

✦ If the reporting company was formed, incorporated, or registered after January 1, 2024, the initial BOI report will be due 90 days following confirmation (actual or public notice) of formation, incorporation or registration from the secretary of state or similar body.

✦ If a reporting company is formed in 2025 or later, the report will be due 30 days following confirmation (actual or public notice) of formation, incorporation or registration from the secretary of state or similar body.

-

Each reporting company that is required to report company applicants must identify and report to FinCEN at least one company applicant and no more than two. All company applicants must be individuals. There are two categories of company applicants: the “direct filer” and the individual who “directs or controls the filing action.”

Category 1: Direct Filer

✦ The individual who filed the document that established the domestic reporting company or the document that initially registered the foreign reporting company entity to conduct business in the United States.

✦ All reporting companies that have a company applicant reporting requirement must identify the direct filer.

Category 2: Directs or controls the filing action.

✦ is the person with primary authority over directing or controlling the filing of the relevant document by another.

✦ The second type of company applicant must be reported only if more than one person was involved in the filing of the document that created or first registered the company.

(See Chart 3)

-

Required Information About the Reporting Company in BOI’s report

1. The full legal name of the reporting company;

2. Any trade names or “doing business as” (DBA) names;

3. The company’s complete current US physical address;

4. The state, tribal or foreign jurisdiction of formation; and

5. For a foreign reporting company only. State or Tribal jurisdiction of first registration.

6. The company’s EIN and TIN

A reporting company must also indicate whether it is filing an initial report, a correction, or an update of a prior report.

-

For Each Beneficial Owner and Company Applicant

1. Full legal name

2. Date of birth

3. Complete current address

4. A unique identifying number from a state- issued driver's license, passport, or other similar document, as well as a scanned image of the document containing the unique identifying number used on the BOI Report

-

The Reporting Rule contains four special reporting rules that may have an impact on a company's reporting obligations.

1. Exempt entity. You are not required to report information on any beneficial owner whose ownership interests in a reporting company are held through one or more entities that are all exempt from the definition of a reporting company. This special rule allows you to report the names of all exempt entities instead of the beneficial owner of your company through ownership interests in those entities

2. A minor child who is a beneficial owner of the reporting company does not need to be reported. Report the child's parent or legal guardian instead of the child under this special rule. BOI reports must indicate that the information is about a minor child's parent or legal guardian.

3. Foreign pooled investment vehicle. If your company was formed under foreign law and would be a reporting company without Exemption #18, you do not need to report beneficial owners and company applicants.

✦ Under this special rule, you must report one person with substantial company control.

✦ If more than one person has substantial control over the company, you must report information about the person with the most authority over the company's strategic management.

4. Existing companies do not need to report company applicant information if they were created or registered before January 1, 2024.

✦ If this exception applies, do not report company applicants.

✦ Indicate on the BOI report that the company was established or registered prior to January 1, 2024.

-

The BOI report must be submitted electronically via a secure filing system.

FinCEN will not accept BOI reports until January 1, 2024. The FinCEN filing system is currently under construction and will not be available until January 1, 2024.

FinCEN will issue instructions and other technical guidance on completing the BOI report form. This guidance will be available at: www.fincen.gov/boi.

If a reporting company is unable to file a BOI report electronically through FinCEN's secure filing system, it should contact FinCEN at www.fincen.gov/contact.

-

A FinCEN identifier is a unique identifying number that FinCEN will issue to (1) individuals who have provided their BOI and to (2) reporting companies that have filed initial BOI reports.

An individual or a reporting company can be assigned a single FinCEN identifier.

The reporting companies can use the beneficial owner’s or company applicants FinCEN identifiers in lieu of the four pieces of personal information required in BOI reports for beneficial owners or company applicants.

-

Individuals may apply for FinCEN identifiers electronically on or after January 1, 2024, by completing an electronic web form.

An applicant must provide their name, date of birth, address, unique identifying number, and issuing jurisdiction from an acceptable identification document, as well as an image of the document.

After submitting an application, an individual will be assigned a FinCEN identifier that is unique to that individual.

-

When submitting a BOI report, a reporting company may request a FinCEN identifier by checking a box on the reporting form. Following the submission of the report, the reporting company will be assigned a FinCEN identifier that is unique to that company.

If a reporting company wishes to request a FinCEN identifier after submitting its initial beneficial ownership report, it may do so by submitting an updated BOI report, even if the company does not otherwise need to update its information.

-

An individual or reporting company is not required to obtain a FinCEN identifier.

-

A company must file a new BOI report no later than 30 days after the date of the change if any of the required information about the company or its beneficial owners changes after the first report was filed.

The same 30-day deadline applies to changes in information that a person submits in order to obtain a FinCEN identifier.

A reporting company is not required to file an updated report for any changes to previously reported personal information about a company applicant.

-

The reporting company must correct any inaccurate filing within 30 days of discovering any inaccuracies.

Inaccuracies in information submitted by an individual in order to obtain a FinCEN identifier are subject to the same 30-day timeline.

Corrected BOI reports should be submitted electronically through the secure filing system.

Note: There are no penalties for filing an inaccurate BOI report, provided that the reporting company voluntarily submits a report correcting the information within 90 days of the deadline for the original report.

-

If a reporting company filed a BOI report but later became exempt from filing the report, it must file an updated report indicating that it is no longer a reporting company.

An updated BOI report for a newly exempt entity will only require that the entity: (1) identify itself; and (2) check a box indicating its newly exempt status.

-

Willful failure to provide FinCEN with complete or updated beneficial ownership information, willful provision to or attempt to provide false or fraudulent beneficial ownership information, may result in civil penalties of up to $500 for each day that the violation continues or criminal penalties including imprisonment for up to 2 years and/or a fine of up to $10,000.

Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure.

If someone willfully causes a company to fail to submit a required BOI report or provided FinCEN with inaccurate or incomplete beneficial ownership information, may face civil and/or criminal penalties.

Chart 1

What is a reporting company for BOI Purpose?

This chart shows how to determine whether your company is a reporting company.

Chart 2

What entities are exempt from the BOI reporting requirements?

The Reporting Rule expressly excludes from the definition of “reporting company” 23 specific types of entities that belong to certain categories of larger and more heavily regulated entities.

Chart 3

Who is a company applicant for a reporting company?